Glenn Karisch’s Texas Probate Resources

Welcome to the Texas Probate Resources website, your source for information on estate planning, probate, and trust law in Texas. This site is owned and maintained by Glenn Karisch of Karisch Jonas Law, PLLC, in Austin, Texas. For information dating from before February 1, 2011, visit the legacy site at texasprobate.net.

Texas Probate

Decanting

The modernization and liberalization of Texas trust law that began with enactment of the two UPIAs (the Uniform Prudent Investor Act and Uniform Principal and Income Act) in 2003 continued in 2013 with enactment of Texas’s first default decanting statute. New Subchapter D of Chapter 112 of the Trust Code (Sections 112.071 – 112.087) permits a trustee to distribute trust principal “in further trust” in some cases.

Several states have preceded Texas in permitting trustees to move property from one trust to another even if the first trust does not expressly authorize the move. Since it is always better to use an obscure word when one is available rather than a word that is easy to understand, these statutes are known as “decanting” statutes. They permit the trustee to “decant” (pour) principal from one trust into another if the conditions stated in the statute are met.

Trustees have used decanting statutes in other states to fix problems in irrevocable trusts. For example, the trustee of a trust with archaic administrative provisions may use the statute to move trust property into a new trust with modern administrative provisions. Of course, it is not always clear that the problem is a “problem” at all, nor that the settlor of the trust would want it to be “fixed” in this way.

Under prior law, there was no default statutory decanting provision that applied if the trust instrument was silent, but the settlor could provide for decanting in the trust instrument. Under the new law, the settlor may expressly provide for decanting or expressly prohibit decanting. If the trust instrument is silent, then the new decanting rules apply.

The Texas statute distinguishes between “full discretion trusts” and “limited discretion trusts.” In a full discretion trust, the trustee’s power to distribute is not limited in any manner. In limited discretion trusts, the power to distribute is limited in some way. HEMS trusts – trusts permitting the trustee to distribute property for the beneficiary’s health, education, maintenance and support – are “limited discretion trusts” under the Texas statutes.

Under the decanting statute, the trustee may distribute principal from a full discretion trust to another trust for the benefit of one or more of the current beneficiaries of the first trust. Also, the trustee may give a wholly discretionary beneficiary a broad power of appointment. The justification for these actions is that, if the trustee could distribute the entire principal to a beneficiary, the trustee ought to be able to make that distribution in further trust with new rules for a beneficiary.

In order to decant from a limited discretion trust, the current beneficiaries of both trusts must be the same, the successor and remainder beneficiaries of both trusts must be the same, and the distribution standard of both trusts must be the same. Due to these limitations, it is likely that the decanting power in limited discretion trusts will be useful only for administrative changes.

When decanting, the trustee must act in good faith, in accordance with the terms and purposes of the trust and in the interests of the beneficiaries. In no case is the trustee deemed to have a duty to decant. The power to decant is reduced to the extent it would cause any intended tax benefits to be lost.

When decanting, the trustee may not take away a beneficiary’s mandatory distribution right, materially impair the rights of any beneficiary, materially lessen the trustee’s fiduciary duty, decrease the trustee’s liability or exonerate the trustee, or eliminate another person’s power to remove the trustee.

Significantly, the trustee may not modify the applicable rule against perpetuities period, “unless expressly permitted by the terms of the first trust.” This eliminates one of the key reasons why a trustee may wish to decant. Still, this gives Texas estate planning attorneys a drafting tip: in appropriate cases, include language in the trust instrument making it clear that the perpetuities period may be modified by decanting. In most cases, there is very little downside to doing this, since most clients have not given a lot of thought to the vested remainder beneficiary rights of their unborn remote descendants when they create trusts.

The trustee must give 30 days’ written notice to current beneficiaries and presumptive remainder beneficiaries. If a charity is a beneficiary, the notice also must be given to the attorney general. If no one objects during the 30-day notice period, the trustee may decant without judicial approval, although the trustee may seek judicial approval if desired. If a beneficiary other than the attorney general objects, the trustee may seek judicial approval but is not required to do so. If the attorney general objects, the trustee must seek judicial approval before decanting.

The trustee may not decant without judicial approval solely to change the trustee compensation provisions. However, the trustee may change compensation provisions without judicial approval if the change is in conjunction with other changes for which there are valid reasons, so long as the change does not provide for unreasonable compensation under Texas law.

Except as otherwise provided in the trust instrument, the decanting provisions apply to trusts existing or created on or after September 1, 2013. Interestingly, the effective date provision states that the Legislature intends the decanting provisions “to be a codification of the common law of this state in effect before the effective date of this Act.” The Legislature does not get to say what the law was before it enacts a statute, but this is an attempt to bolster the argument that there already existed a common law power to decant in Texas.

New Medical Power of Attorney Form

The Medical Power of Attorney Form and related disclosure statement were modified to adapt to the 2009 change which permits the medical power of attorney to be signed before a notary rather than two witnesses. Tex. Health and Safety Code Sec. 166.163 and 166.164. The new forms become effective January 1, 2014.

Here is the new medical power of attorney form for use beginning January 1, 2014, in Word and pdf formats.

New Statutory Durable Power of Attorney Form

One of the most frequent complaints to REPTL from probate lawyers in the 1990s was “don’t keep changing the power of attorney form.” Like the wall in the Game of Thrones, REPTL has resisted changes to the statutory durable power of attorney form since 1997. While the 1997 form had a good, long run, as in George R. R. Martin’s tomes, every so often the wildings scale the wall. The statutory durable power of attorney form will change effective January 1, 2014. This bill was not a REPTL bill, so do not blame REPTL for its passage.

The new power of attorney form (Tex. Est. Code Sec. 752.051) differs from the former in three principal ways:

- Initial, don’t cross out. It drops the approach of the former form, in which the principal crosses out any specific powers he or she does not wish to give to the agent, for an initialing approach, in which the principal initials powers he or she wishes to give to the agent. This approach is consistent with the 2006 version of the Uniform Power of Attorney Act. Texas had tried the initialing approach from 1993 to 1997, but dropped it in favor of the crossing-out approach in an attempt to prevent fraud and to reduce errors in self-help execution of powers of attorney.

- The form begins with a notice to the principal. The principal is warned that he or she should select someone he or she trusts and that the power of attorney will continue until the principal dies, the principal revokes it, the agent resigns or is unable to act or a guardian is appointed for the principal’s estate.

- The form ends with “Important Information for Agent.” The form makes extensive statements of the agent’s duties, the termination of the agent’s authority and the liability of the agent. To a large extent, these statements are consistent with the Durable Power of Attorney Act and fiduciary law. However, to the extent that the statements are not identical to current statutory law, does including these statements in the form create additional statutory or contractual duties and liabilities? If there are inconsistencies, which controls – existing law or the disclosure statements in the form?

In addition to increasing the chances of fraud (since it is easier for a bad guy to add initials to a form than to remove a cross-out mark), the new initialing approach creates these two traps for the unwary:

1. No automatic general power of attorney. The former cross-out form contains this statement:

If no power listed above is crossed out, this document shall be construed and interpreted as a general power of attorney and my agent (attorney in fact) shall have the power and authority to perform or undertake any action I could perform or undertake if I were personally present.

Tex. Prob. Code Sec. 490(a). The new form has no such provision. It permits the principal to initial line “N” – “all of the above powers listed in “A” through “M.” However, this does not make the power of attorney a general power of attorney and there is no similar provision stating that it means the agent has the power to perform or undertake any action the principal could perform or undertake if personally present. Rather, the agent’s authority apparently will be limited to the enumerated statutory powers even if “N” is initialed. For this reason, it is important for any attorney wishing for his or her client to have a general power of attorney to specifically add language to the form to accomplish this purpose.

2. What happens if no powers are initialed? Since these forms are used by non-lawyers, it is inevitable that powers of attorney will be signed with no powers initialed. What is the effect of this? Unless the principal adds specific authority in the “special instructions” section of the form, presumably the agent has no authority to act, even though the principal must have intended to give the agent some authority or he or she would not have signed the power of attorney in the first place.

As troublesome as the 2013 changes to the form are, they should present no insurmountable hurdle for attorneys familiar with this area of the law. Here are practice tips about the new form:

- Use the form. Although this is a matter of personal preference, having one’s clients sign a form that looks like the statutory form is likely to increase the likelihood of third party acceptance.

- Accept the initialing approach. Use of the statutory form is optional, so there is no reason why an attorney could not continue to use the crossing-out approach. However, in the controlled environment most attorneys create for document signings, it is not difficult to assure that clients initial the form at the appropriate place.

- Modify the form. Modify the form to include those powers which you believe your principal may need to have. For example, the form may expand on the power to make gifts, add the power to create trusts and transfer property to trusts, and clarify the agent’s authority to deal with governmental agencies.

- Make it a general power of attorney. Add language to make it clear that it is a general power of attorney.

- Specifically provide that it is to be construed as a statutory durable power of attorney. Even though the use of the statutory form is optional, it probably is advantageous to have the power of attorney construed to be a statutory durable power of attorney. This assures that the powers described in Tex. Est. Code Sections 752.101 – 752.114 are included in the power.

Here are the new statutory durable power of attorney forms for use beginning January 1, 2014 in Word and pdf formats. Here is the new form with modifications and enhancements by Glenn Karisch in Word and pdf formats.

Substantive Changes Related to Estates Code Enactment

While the Legislative Council was making its non-substantive codification, REPTL and others were busy making substantive changes. Many of these changes are the ordinary tweaks that REPTL and others have been making every two years for the past 3 decades. (The 2013 crop of these changes is discussed elsewhere in this summary). However, some are related to the enactment of the Estate Code itself.

REPTL learned in 2006 that the Probate Code codification was coming whether it liked it or not. REPTL leadership appointed a special committee to consider the codification and to offer advice and assistance to the Legislative Council. This committee also noted that there were a few subjects in the Probate Code that needed to be addressed substantively before the existing statutes were swept wholesale into the new code. REPTL pushed for changes in these subjects. Those changes have been enacted into the Probate Code and will be codified into the Estates Code.

For this reason, lawyers should look more carefully at the Estates Code provisions enacted on these subjects:

- Probate and Guardianship Jurisdiction and Venue. The Legislature has amended the statutes governing probate jurisdiction frequently since the 1970s. This has corresponded with the creation of statutory probate courts and the growth of those courts’ jurisdiction. In addition to statutory changes, there have been significant appellate cases construing probate jurisdiction. This led to confusion and convoluted statutory provisions. Much of this confusion arose from the meaning of the phrase “appertaining or incident to an estate.” REPTL believed that a re-codification of probate jurisdiction statutes should try to eliminate some of this confusion. Therefore, legislation passed during the last three sessions has made significant changes. The most significant changes are:

- Defining a “probate proceeding.” Tex. Prob. Code Sec. 3(bb); Tex. Est. Code Sec. 31.001.

- Defining a “matter related to a probate proceeding,” which definition varies based on the type of court exercising the jurisdiction. Tex. Prob. Code Sec. 4B; Tex. Est. Code Sec. 31.002.

- Giving county courts at law in counties having no statutory probate court the jurisdiction to hear matters related to testamentary and inter vivos trusts created by a decedent whose will was probated in that county. Tex. Prob. Code Sec. 4B(b); Tex. Est. Code Sec. 31.002(b).

Some practitioners consider these changes constitute an expansion of the exclusive jurisdiction of courts exercising original probate court jurisdiction. However one views these changes, it behooves lawyers working in probate and guardianship cases to review these provisions of the Estates Code carefully.

- Independent Administration. REPTL advocated for and the Legislature responded with several changes affecting independent administrations. Some of these were of a housekeeping nature. Others made significant changes. Here are some of the highlights.

- Previously the Probate Code had only vague references to what an independent executor could and could not do without court approval. (See, for example, old Section 145(h): “… further action of any nature shall not be had in the county court except where this Code specifically and explicitly provides for some action in the county court.”) The new provision states plainly that:

Unless this title specifically provides otherwise, any action that a personal representative subject to court supervision may take with or without a court order may be taken by an independent executor without a court order. The other provisions of this subtitle are designed to provide additional guidance regarding independent administrations in specified situations, and are not designed to limit by omission or otherwise the application of the general principles set forth in this chapter.

Tex. Est. Code Sec. 402.002; Tex. Prob. Code Sec. 145B (added in 2011).

- The power of an independent executor to sell real property is clarified and a new procedure for making the order appointing the independent executor include a power of sale is added. Tex. Est. Code Sec. 402.051 – 402.054; Tex. Prob. Code Sec. 145A and 145C (added in 2011).

- The creditors’ claims provisions in independent administrations were overhauled. Tex. Est. Code Sec. 403.051 et seq.

- Affidavits in lieu of inventory are permitted. Tex. Est. Code Sec. 309.056.

The Estates Code

The biggest legislative change in probate law in decades is happening, but it is not really much of a change at all. On January 1, 2014, the Estates Code replaced the Probate Code. Yes, the Probate Code, which has been around for 60 years, will be no more. Yes, probate lawyers and courts will have to learn many new chapter and section numbers. But no, the law itself is not changing – at least, not very much.

The Texas Legislative Council, a state agency, is charged with planning and executing a code-based statutory revision program to “clarify and simplify the statutes and to make the statutes more accessible, understandable, and usable.” Tex. Govt. Code Sec. 323.007(a). Since 1963, it has been taking sections of the old Vernon’s Annotated Texas Statutes (a proprietary system owned by West Publishing Company) and placing them in a series of codes. Most probate lawyers have worked for years with the Property Code and the Family Code. Now they will have to adjust to the Estates Code.

When revising a statute, the Legislative Council “may not alter the sense, meaning, or effect of the statute.” Tex. Govt. Code Sec. 323.007(b). For this reason, while the location of various provisions is changing and some of the terminology is changing, the law itself is not supposed to be changing. (See "Substantive Changes Related to Estates Code Enactment" for significant exceptions to this.)

The Estates Code is organized in the familiar chapter and section format of other Texas codes:

Decedents’ estates

Chapters 31 – 551

Powers of attorney

Chapters 751 – 752

Guardianships

Chapters 1001 – 1253

Management trusts and other guardianship alternatives

Chapters 1301 -- 1356

Three questions about the new Estates Code:

Q: I have an estate under administration that was started before January 1, 2014. Do I follow the Probate Code or the Estates Code? A: Both. Each section of the Probate Code is repealed effective January 1, 2014, and the Estates Code becomes effective on the same day. Nothing in the statute says otherwise, so there is no reason to think that the Estates Code will apply only to persons dying on or after that date. Section 21.006 of the Estates Code says that “the procedure prescribed by Title 2 [the Decedents’ Estates portion of the code] governs all probate proceedings.” So, you should cite and follow the Probate Code provisions through December 2013 and cite and follow the Estates Code provisions beginning in January 2014.

Q: Will I have to re-plead everything with the new section numbers? A: Hopefully that is a silly question. Surely the courts will treat a pleading that was proper under the Probate Code as continuing to apply without the need for re-pleading. On the other hand, judges and lawyers have taken different views of other recent legislative changes (don’t get me started), so it is best to check with the court in question. Perhaps judges will enact local rules to clarify this issue.

Q: Do I need to change all of the statutory references in my will form? A: Yes, for wills signed on or after January 1, 2014. While the Estates Code contains a provision that makes statutory references to prior law apply to the new, revised statutes (Tex. Est. Code Sec. 21.003(a)), it does not have a provision that makes references in wills and other instruments to prior statutes apply to new versions of the statutes. The Code Construction Act (which applies to the Estates Code) provides that “[u]nless expressly provided otherwise, a reference to any portion of a statute or rule applies to all reenactments, revisions, or amendments of the statute or rule.” Tex. Gov. Code Sec. 311.007. However, it is likely that this section applies to “references” in other statutes, not references in instruments such as wills. When the Texas Trust Code was enacted in 1983, the Legislature made clear that the Trust Code was considered an amendment to the Texas Trust Act (repealed by the Trust Code) for purposes of references in trust instruments. Tex. Trust Code Sec. 111.002. There is no similar provision in the Estates Code. Of course, the guiding principle in will construction is determining the testator’s intent, so it should not be too hard to prove that a testator who referred to Section 145 of the Probate Code intended a reference to the appropriate corresponding section of Chapters 401 – 405 of the Estates Code. Still, it will be unprofessional to produce documents after January 1, 2014, containing out-of-date statutory references.

Requiring attorney signatures on probate affidavits

Travis County Probate Court No. 1 is rejecting affidavits in lieu of inventory filed by non-lawyer personal representatives pursuant to Texas Probate Code Section 250 unless they also include the signature of the attorney of record. Judge Guy Herman believes that the filing of an affidavit by a non-lawyer personal representative constitutes the unauthorized practice of law. He also thinks that there is a strong policy argument for requiring the attorney of record to sign since it lets the court know that the attorney is aware of the filing and is still involved in the administration.

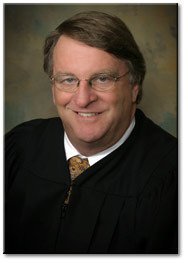

Judge Guy Herman

Judge Guy HermanIn Steele v. McDonald, 202 S.W.3d 926 (Tex. App. -- Waco 2006), the court held that a non-lawyer may not appear pro se in the capacity as an estate's independent executor. The court reasoned that, since the executor is acting in a representative capacity, appearing pro se would constitute the unauthorized practice of law. A Texas court also has prohibited a non-lawyer trustee from appearing in a lawsuit in his representative capacity. In re Guetersloh, 326 S.W.3d 737 (Tex. App. -- Amarillo 2006).

The Probate Code requires personal representatives to file affidavits of compliance with Section 128A and a sworn inventory or affidavit in lieu thereof. Most attorneys routinely sign the inventory. However, there is nothing in Section 128A or Section 250 requiring attorneys to sign the inventory or those affidavits. I do not think filing a statutorily-required factual statement constitutes practicing law, so I do not think the attorney's signature should be required. The forms for Section 128A affidavit and affidavit in lieu of inventory I prepared and put on this website have no place for the attorney to sign.

Still, those of us who practice in Travis County need to comply with Judge Herman's requirements. Also, Judge Herman's practices often influence the practice in other Texas courts. Therefore, I have added to the website an affidavit in lieu of inventory form with a place for the attorney to sign and an affidavit of compliance with Section 128A form with a place for the attorney to sign. Adding the attorney's signature is easy, so that will be my practice from now on.

Ten things to do now

(This is one of a series of posts about 2011 legislation.)

Most of the legislation passed by the 82nd Texas Legislature becomes effective September 1, 2011. Here are ten things an estate planning and probate attorney should do now to address the new legislation.

1. Change will forms to use streamlined one-step execution

SB 1198 amends Probate Code Section 59 to permit an optional new way for a will to be executed and be made self-proved -- one which requires the testator and two witnesses to sign only once. Attorneys should change their will forms to replace the attestation clause and self-proving affidavit with the new approved language. Here are Word and WordPerfect versions for downloading.

The method is optional, so attorneys may continue to use the traditional two-signature method. However, there seems to be little downside to switching to the new method. The new method will make execution errors much less likely, and it speeds up the signing ceremony. If the client moves to another state which does not recognize a combined attestation and self-proving affidavit, the will still will be just as valid as the two-signature variety, although it may not be considered self-proved. It is likely to be considered self-proved in that state, since Section 2-504 of the Uniform Probate Code permits combined attestations and self-proving affidavits, and the UPC has been enacted in one form or another in 20 states.

The new procedure is available for wills signed on or after September 1, 2011. For more information about this change, see this blog post.

2. Use all of the streamlined forms to speed up document signings

The 2011 change to Section 59 (allowing combined attestations and self-proving affidavits) completes a series of changes begun in 2009 that can speed up document signing ceremonies and save staff time. While updating the will form to use the one-signature method, also check the medical power of attorney, directive to physicians and declarations of guardian to assure that each takes advantage of the 2009 changes:

The medical power of attorney may be acknowledged by a notary instead of witnessed by two witnesses. Tex. Health & Safety Code Sec. 166.154(b). Here is a medical power of attorney form using a notary instead of witnesses in Word format.

The directive to physicians and family or surrogates may be acknowledged by a notary instead of witnessed by two witnesses. Tex. Health & Safety Code Sec. 166.032(b-1). Here is a directive to physicians form using a notary instead of witnesses in Word format.

The declaration of guardian in the event of later incapacity may contain a combined attestation and self-proving affidavit, making it necessary for the declarant and witnesses to sign only once. Tex. Prob. Code Sec. 679(k). Here is a declaration of guardian form using the one-signature method in Word format.

The declaration of guardian for children may contain a combined attestation and self-proving affidavit, making it necessary for the declarant and witnesses to sign only once. Tex. Prob. Code Sec. 677A(i).

As a result of the 2009 and 2011 changes, attorneys can streamline document executions:

If the attorney is a notary, the attorney may meet with the client alone and supervise the signing of any trusts, the statutory durable power of attorney, the medical power of attorney, the directive to physicians, the HIPAA authorization, the funeral directive and any beneficiary designations.

After completing those documents, the witnesses may enter the room for the signing of the will and the declarations of guardian using the new one-signature method.

3. Begin using affidavits in lieu of inventories

SB 1198 amended Section 250 of the Probate Code to permit independent executors and administrators to file an affidavit instead of a detailed inventory if there are no unpaid debts, except for secured debt, taxes and administration expenses, when the inventory is due. The independent executor or administrator still must prepare a verified inventory and deliver it to each beneficiary, but the public disclosure of estate assets and values may be avoided.

Here are Word and WordPerfect versions of a form of affidavit in lieu of inventory for downloading.

Affidavits in lieu of inventory may be used for the estates of decedents dying on or after September 1, 2011. For more information about this change, see this blog post.

4. Change wills to authorize affidavits in lieu of inventories

While it is clear that the legislature intended affidavits in lieu of inventories when the testator's will provided for independent administration, an anomaly in Section 145(b) of the Probate Code raises a possible argument that the required language creating independent administrations negates the right to use an affidavit in lieu of inventory. Section 145(b) provides:

Any person capable of making a will may provide in his will that no other action shall be had in the county court in relation to the settlement of his estate than the probating and recording of his will, and the return of an inventory, appraisement, and list of claims of his estate.

Texas attorneys routinely include this language in wills. A possible interpretation of this language is that, while Texas law might otherwise permit the independent executor to file an affidavit in lieu of inventory, the terms of the will nevertheless require the filing of an inventory. This is implausible and clearly contrary to legislative intent. It is likely to be clarified by 2013 legislation. In the meantime, Texas attorneys should modify this phrase in wills signed in the future to make it clear that the inventory must be filed only if required by law. It probably is overkill to require former clients to re-execute wills with the new language.

Here is the language I recommended:

I direct that no action shall be had in any court exercising probate jurisdiction in relation to the settlement of my estate other than the probating and recording of my will and the return of an inventory, appraisement and list of claims of my estate; provided that, if the independent executor is permitted to file an affidavit in lieu of inventory under Texas law, I do not require the independent executor to file the inventory, appraisement and list of claims with the court.

Bill Pargaman recommended simply adding "...if required by law" to the end of the Section 145(b) language.

For more information, see this blog post.

5. Consider using a summary-form 128A notice

SB 1198 amended Section 128A to permit the executor to include a summary of key provisions in the required notice to beneficiaries instead of enclosing a full copy of the order and will. Under the revised statute, the executor either must enclosed a copy of the will and order or "a summary of the gifts to the beneficiary under the will, the court in which the will was admitted to probate, the docket number assigned to the estate, the date the will was admitted to probate, and, if different, the date the court appointed the personal representative." The summary option also may be used in waivers signed by beneficiaries in lieu of notice.

Should attorneys routinely use the new method? It will save postage and trees not to have to send copies of the order and will. On the other hand, it always is possible that a court later will consider the summary to be incomplete or insufficient. Also, while attorneys can standardize the sending of 128A notices with the will and order attached, use of the summary is likely to require special drafting and editing.

There were other changes to the statute requiring notice to beneficiaries. Fewer persons must be notified.

For old "long form" Section 128A notice and affidavit forms, click here. There are no new "summary form" notices on this site. For more information about Section 128A changes, see this blog post.

6. Complete disclaimers for 2010 decedents by September 16

The tax law passed by Congress in 2010 extended the deadline for disclaiming property that would otherwise be received from a decedent dying between January 1, 20102011, and December 17, 20102011, until 9 months after December 17, 20102011. The Texas legislature made corresponding extensions of the state deadlines for disclaimers. The deadline under federal and state law is September 17, 2011. Since September 17 falls on a Saturday, be sure to complete the disclaimer by Friday, September 16, since it is unclear that the Texas deadline would be extended to the following business day. [corrected September 14, 2011]

7. Make sure to follow the rules for Section 294(d) notices to unsecured creditors

SB 1198 made many changes affecting independent administration. As amended, Probate Code Section 146 makes it clear that Section 294(d) notices to unsecured creditors may be used in independent administrations to bar claims that are not made within 120 days of receipt of the notice. However, when used in an independent administration, the notice must state that a claim may be effectively presented by only one of the methods prescribed by Section 146. Section 146(b-4) prescribes these methods of giving notices by creditors:

A written instrument that is hand-delivered with proof of receipt, or mailed by certified mail, return receipt requested with proof of receipt, to the independent executor or the executor’s attorney;

A pleading filed in a lawsuit with respect to the claim; or

A written instrument or pleading filed in the court in which the administration of the estate is pending.

When representing independent executors, make sure the notice to unsecured creditors contains the proper language. When representing creditors, make sure to respond to the notice in one of the ways required by Section 146.

Here is a form for Section 294(d) notices in independent administrations in Word and WordPerfect formats.

8. Check the power of sale before applying for the next independent administration

SB 1198 makes it clearer whether or not an independent executor or administrator has the power to sell real estate without the joinder of the beneficiaries. If the will does not contain a power of sale provision, Section 145A permits the distributees to agree to give the independent executor or administrator the power of sale. It is important to note that this consent must be obtained before the personal representative is appointed so that the order appointing him or her may state that the power of sale exists. If the personal representative does not obtain the consent of the distributees prior to appointment, it is too late -- each sale of real estate from the estate is likely to require the joinder of the beneficiaries.

Therefore, before applying for the next independent administration, check the will for a power of sale. If there is not a power of sale in the will, consider whether to ask the distributees to agree to the power of sale before filing the application.

The changes to the power of sale in independent administrations are discussed in this blog post.

9. Consider if the 2011 changes create new opportunities for elder law clients

Over the past several sessions, Texas statutes have been amended to make it easier for clients of elder law attorneys to qualify for government benefits programs. The 2011 changes open the door even further.

Now persons with physical disabilities only but with no mental incapacity may apply for the creation of a court-created trust under Section 867 of the Probate Code. This will make it easier for disabled individuals to utilize a special needs trust. The federal statute (42 U.S.C. Sec. 1396p(d)(4)(A)) requires that trusts be created by a parent, grandparent or court. It was unclear if a disabled person with no mental incapacity was eligible for an 867 trust. The 2011 changes make it clear that the trusts are available for disabled persons, who may apply for their creation directly, without the need for a guardianship. Disabled persons also may waive the annual accounting requirement otherwise applicable to 867 trusts.

It is easier than ever to get a qualifying individual's property into a pooled trust subaccount administered under 42 U.S.C. Sec. 1396p(d)(4)(C). Probate Code Section 911 lists the persons who may apply fo the establishment of a subaccount. The list does not include the trustee of a Section 867 trust. However, Section 868C permits the court to order the transfer of the assets of an 867 trust into a pooled trust subaccount, so the trustee may use that statute to, in effect, apply for the creation of a subaccount.

Section 865 of the Probate Code was amended to permit a guardian of the estate or any interested person to apply to the court to transfer a portion of a ward's estate as necessary to qualify the ward for government benefits, but only to the extent allowed by applicable state or federal laws, including rules, regarding those benefits.

Each of these changes was made by SB 1196, the guardianship bill supported by the Real Estate, Probate and Trust Law Section of the State Bar of Texas.

10. Review the new Estates Code

The current Probate Code will be repealed and replaced by the new Estates Code on January 1, 2014. The Texas Legislative Council has been working on the nonsubstantive codification of the Probate Code since 2007. The decedents' estates portion of the code was enacted in 2009. The guardianship and power of attorney portions were enacted in 2011. A corrections bill was passed in 2011. A final corrections bill will be enacted in the 2013 session prior to the January 1, 2014, effective date. Members of the Real Estate, Probate and Trust Law Section have been scouring the new provisions to see if any changes or corrections need to be made. REPTL probably will have a bill making changes in 2013.

Now is a good time to review the new Estates Code. The Texas Legislative Council's website has information about the new code and texts of the legislation. Direct any suggested changes or corrections to me or to Bill Pargaman so that REPTL may consider them.

Claims in independent administrations

(This is one of a series of posts about 2011 legislation.)

Section 146 addresses claims in independent administrations. SB 1198 makes several changes:

Section 294(d) permits personal representatives to give notices to unsecured creditors, and those creditors are required to present their claim within 120 days of receipt of the notice, or the claim is barred. Section 146 makes it clear that Section 294(d) notices may be used in an independent administration. However, when used in an independent administration, the notice also must include a statement that a claim may be effectively presented by only one of the methods prescribed by Section 146. (Here are Section 294(d) notice forms for independent administrations which address the 2011 changes in Word and WordPerfect formats.) Section 146(b-4) prescribes these methods of giving notices by creditors:

A written instrument that is hand-delivered with proof of receipt, or mailed by certified mail, return receipt requested with proof of receipt, to the independent executor or the executor’s attorney;

A pleading filed in a lawsuit with respect to the claim; or

A written instrument or pleading filed in the court in which the administration of the estate is pending.

A secured creditor electing matured secured status must give notice to the independent administrator in one of the methods prescribed in Section 146(b-4) (described above) and must record a notice of the creditor’s election in the deed records of the county in which the real property is located.

A secured creditor electing matured secured status in an independent administration is entitled to the priority granted by the Probate Code, but the creditor is not entitled to exercise any remedies in a manner that prevents the payment of higher priority claims and allowances and, during the estate administration, is not entitled to exercise any contractual collection rights, including the power to foreclose, without either the prior written approval of the independent executor or court approval. If the secured creditor elects matured secured status, the independent executor and not the secured creditor is empowered to sell the property if necessary to pay the claim. Still, the creditor with matured secured status is not powerless to protect itself. Section 146(b-1)(2) permits the matured secured creditor to seek judicial relief or to execute a judgment against the independent executor. Section 146(b-1)(3) coordinates with the no right to exoneration of lien statute (Section 71A), requiring the independent executor either to collect from the devisees the amount needed to pay the debt or to sell the property to raise money to pay the debt.

A secured creditor with preferred debt and lien status is free to exercise judicial or extrajudicial collection rights, including the right to foreclose and execution, but the creditor may not conduct a nonjudicial foreclosure sale within 6 months after letters are granted.

In an independent administration, presentation of a statement of claim or a notice with respect to a claim to an independent executor does not toll the running of the statute of limitations with respect to that claim. Except as otherwise provided in Section 16.062 of the Civil Practices and Remedies Code, the running of the statute of limitations in an independent administration is tolled only by:

Written approval of a claim signed by an independent executor;

A pleading in a suit pending at the time of the decedent’s death; or

A suit brought by the creditor against the independent executor.

Section 146(b-7) states plainly that, other than as provided in Section 146, the procedural provisions of the Probate Code governing creditor claims in supervised (dependent) administrations do not apply to independent administrations. Among the procedural provisions that do not apply to independent administrations are Section 306(f) – (k) and Section 313. A creditor’s claim is not barred solely because the creditor failed to file a suit not later than the 90th day after the date an independent executor rejects the claim or fails to act with respect to a claim.

Section affected: Probate Code Section 146.

Power of sale in independent administrations

(This is one of a series of posts about 2011 legislation.)

Most well-drafted wills expressly give the independent executor the power to sell real property. However, some wills do not include a power of sale provision. Also, when the distributees of an intestate estate agree on the appointment of an independent administrator, that administrator serves without the benefit of a power of sale provision. In those cases, when can the independent administrator sell real property without the joinder of the distributees? Under prior law, there was no clear answer to this question. As a result, most title companies would not insure title if an independent administrator without the power of sale tried to sell real property of the estate, unless the distributees joined in the conveyance.

SB 1198 attempts to clarify the rules about sales of real property by independent administrators and to provide a means for independent administrators with no express power of sale to obtain the clear authority to sell real property.

New Section 145A permits the distributees of an estate to give the independent administrator the power of sale in cases where there is no will or where the will does not contain language authorizing him or her to sell real property. The distributees may give the independent administrator the power of sale by signing a consent prior to the appointment of the independent administrator, whereupon the court will include the power to sell in the order appointing the independent administrator. Thus, if the proposed independent administrator knows in advance that he or she may need to sell real property, he or she may ask the distributees to sign a consent giving the independent administrator the power of sale and file these consents with the application for appointment. The court, seeing that the distributees have consented to giving the independent administrator the power of sale, can include the power of sale in the order appointing the independent administrator. This permits title companies and other third parties to rely on that order when the independent administrator wishes to sell real property. If the independent administrator waits until after he or she is appointed to get the power of sale, it is too late – the distributees also must sign the deed (unless the sale is necessary to pay expenses of administration, funeral expenses and expenses of last sickness of decedent, and allowances and claims against the estate – see below.)

New Section 145C confirms that an independent executor has the power to sell real property if that power is expressly given to him or her in the will. In most cases in the Probate Code, the term “independent executor” includes “independent administrators.” This is not the case in Section 145C, however. While an independent executor has the power of sale given in the will, an independent administrator with will annexed does not, since the testator is deemed to have given the power of sale only to the persons he or she named as independent executors in the will and not to an unnamed person later appointed as independent administrator.

Section 145C also provides that, unless limited by the terms of a will, both independent executors and independent administrators have the same power of sale for the same purposes as a personal representative has in a supervised (dependent) administration, but without the requirement of court approval and without the need to comply with the procedural requirements applicable to a supervised administration. Section 341 provides that a personal representative in a supervised administration with court approval may sell property when it appears necessary or advisable in order to:

(1) Pay expenses of administration, funeral expenses and expenses of last sickness of decedents, and allowances and claims against the estates of decedents.

(2) Dispose of any interest in real property of the estate of a decedent, when it is deemed to the best interest of the estate to sell such interest.

Clearly under new Section 145C an independent executor or independent administrator may sell real property if necessary to pay expenses, allowances and claims (Section 341(1)) regardless of whether the will contains a power of sale and so long as the terms of the will do not limit the power of sale. It is not so clear if an independent executor or independent administrator without an express power of sale may sell real property “when it is deemed to the best interest of the estate” (Section 341(2)). Section 145C(b) says he or she has the same power of sale for the same purposes as a dependent administrator, and a dependent administrator may apply to the court for a “best interest” sale, so it appears that independent executors and administrators are given this power. However, Section 145C(c) provides that a good faith unrelated purchaser of real property is protected if there is a power of sale given to the independent executor in the will, if the court grants a power of sale in the order appointing the independent executor or independent administrator, or if “the independent executor or independent administrator provides an affidavit, executed and sworn to under oath and recorded in the deed records of the county where the property is located, that the sale is necessary or advisable for any of the purposes described in Section 341(1) of this code.” Since Section 341(1) permits sales to pay administrative expenses, allowances and claims, while Section 341(2) permits “best interest” sales, there is no third-party protection for “best interest” sales.

After chopping through the bushes on Sections 145A and 145C for a while, it appears that the power of sale in an independent administration may be summarized as follows:

If the will expressly gives a power of sale, the independent executor named in the will has the power to sell real property for any purpose.

An independent administrator with will annexed cannot use a power of sale granted in the will.

If the distributees consent to giving the independent executor or independent administrator the power of sale and the order appointing the independent executor or independent administrator expressly grants the power of sale, the independent executor or independent administrator has the power to sell real property for any purpose.

Unless the terms of a will limits the power, any independent executor or independent administrator may sell real property to pay administrative expenses, allowances and claims or if it is in the best interest of the estate – even if the will or order grant no power of sale – but a good faith third party purchaser will be protected only if the sale is to pay administrative expenses, allowances and claims. The third party is not protected if the reason for the sale is the best interest of the estate.

Section 145C(c)(2) makes clear that the signature or joinder of a devisee or heir is not required as to acts undertaken in good faith reliance on the independent executor’s affidavit that the sale is for the purpose of paying administrative expenses, allowances or claims. Section 145C(c)(3) makes clear that the fact that an independent executor or administrator has the power to sell real property does not relieve him or her from any duty owed to a devisee or her in relation, directly or indirectly, to the sale.

Sections affected: Probate Code Sections 145A and 145C.

Inherited IRAs are Exempt from Creditors’ Claims

(This is one of a series of posts about 2011 legislation.)

SB 1810 amends Section 42.0021 of the Property Code to provide that all IRAs, including inherited IRAs, are exempt from creditors' claims. It provides that the interest of a person in an IRA acquired by reason of the death of another person is exempt to the same extent that the interest of the person from whom the account was acquired was exempt on the date of the person's death.

The exempt status of inherited IRAs was called into question by In re Jarboe, 2007 WL 987314 (Bankr. S. D. Tex 2007), and by similar cases across the country.

Section affected: Property Code Section 42.0021.

Survivorship accounts: Holmes v. Beatty expressly overturned

(This is one of a series of posts about 2011 legislation.)

Holmes v. Beatty, 290 S.W.3d 852 (Tex. 2009), caused shockwaves in the probate and estate planning community for two reasons:

First, and most importantly, the Supreme Court relaxed the standards for creating rights of survivorship with respect to community property, holding that a "joint tenancy" or " JT TEN" designation on an account is sufficient to create rights of survivorship in community property under Section 452 of the Texas Probate Code.

Second, the Supreme Court held that stock certificates issued from a community property with right of survivorship brokerage account continue to be survivorship property even though the the certificates themselves do not meet the requirements for survivorship agreements.

SB 1198 overturns Holmes on the first of these points. It adds this sentence to Section 452: "A survivorship agreement will not be inferred from the mere fact that the account is a joint account or that the account is designated JT TEN, Joint Tenancy, joint, or other similar abbreviation." Parallel language is added to Section 439, which governs non-community property multi-party accounts. SB 1198 specifically states that the bill is intended to overturn the ruling of the Texas Supreme Court in Holmes v. Beatty.

These changes were intended to bring Section 452 – regarding community property with right of survivorship accounts – in line with Section 439 and the principles established by the Texas Supreme Court in Stauffer v. Henderson,801 S.W.2d 858 (Tex. 1990). Those principles apply to community property with right of survivorship accounts notwithstanding the slight differences in language between Sections 439 and 452.

The bill is silent on the other significant holding in Holmes, so stock certificates issued out of community property with right of survivorship accounts may continue to be survivorship property, at least to the extent described in Holmes.

Sections affected: Probate Code Sections 439 and 452.

Will unsworn declarations invade probate practice?

(This is one of a series of posts about 2011 legislation.)

Because of HB 3674, which flew under the radar in 2011, arguably it is no longer necessary to have a notary in most cases were a sworn statement or affidavit is made. The statute amends Section 132.001 of the Civil Practice and Remedies Code – which previously only dealt with unsworn statements by inmates – to provide that an “unsworn declaration may be used in lieu of a written sworn declaration, verification, certification, oath, or affidavit required by statute or required by a rule, order, or requirement adopted by law.” The unsworn declaration must be in writing and subscribed by the person making the declaration as true under penalty of perjury. A specifc form of non-notarized jurat must be used. There are exceptions for an oath of office or an oath required to be taken before a specified official other than a notary public. The bill becomes effective September 1, 2011, and applies to unsworn declarations made on or after that date.

Is a will containing an unsworn declaration self-proved as required by Section 59 of the Probate Code? Probably not. For one thing, the testator and each witness would have to make an unsworn declaration, not just the testator. For another, a court is likely to find that the use of an unsworn declaration is not “in form and contents substantially” as required by Section 59. Also, since the consequences of a court’s refusal to accept an unsworn declaration on a will is that it is not self-proved (rather than that it is not entitled to probate), it is hard to imagine anyone appealing a decision of a court refusing to accept it.

Sworn statements are permitted or required at least 70 times in the decedents’ estates portion of the Probate Code. (The author grew tired of counting before getting to guardianships.) With some of these statutes, it may be appropriate to permit someone to make an unsworn declaration under penalty of perjury rather than a notarized statement. In others, it clearly is a bad idea.

Time will tell if probate judges will permit the use of these declarations. In the meantime, the simple, worry-free answer for a probate practitioner is to use notarized sworn statements and affidavits.

New will-signing procedure: the testator and witnesses need sign only once

(This is one of a series of posts about 2011 legislation.)

Under prior law, in order to make a will self-proved, the testator and each witness had to sign the will twice – once on the will itself and once on the self-proving affidavit. SB 1198 amends Section 59 of the Texas Probate Code to permit combining the execution of the will with the signing of the self-proving affidavit so that the testator and witnesses only have to sign once. The statute includes the appropriate language to include in the will if the one-signature method is desired.

The one-signature method is optional. Testators still may use the two-signature method.

The change to Section 59 corresponds with changes to Sections 677A and 679 made in 2009 which adopted a one-signature method for declarations of guardian. Other changes in 2009 made it possible to use a notary public in lieu of witnesses on medical powers of attorney and on directives to physicians and family or surrogates. As a result of the 2009 and 2011 changes, attorneys may greatly streamline the document signing ceremony:

The statutory durable power of attorney, medical power of attorney and directive to physicians or family and surrogates may be executed before a notary public, and no witnesses are required.

The will, the declaration of guardian for minor children and the declaration of guardian in the event of later incapacity require two witnesses, but the testator/declarant and the witnesses need sign only once.

The new will-signing method becomes available on September 1, 2011.